As sustainability frameworks, risks, and opportunities evolve globally, our experts have identified 6 key trends for 2025 to help businesses navigate critical decisions in compliance, strategy, and supply chain management.

Companies beyond the EU are preparing for the CSRD and double materiality assessment. Leading organizations are transitioning from disclosures to action. Sustainability continues to prove its benefit as a core strategy for risk management. Businesses are progressing beyond carbon tunnel vision, with CDP expanding their focus from emissions to a broader “Earth-positive impact.” Read on to find out what’s next for corporate sustainability.

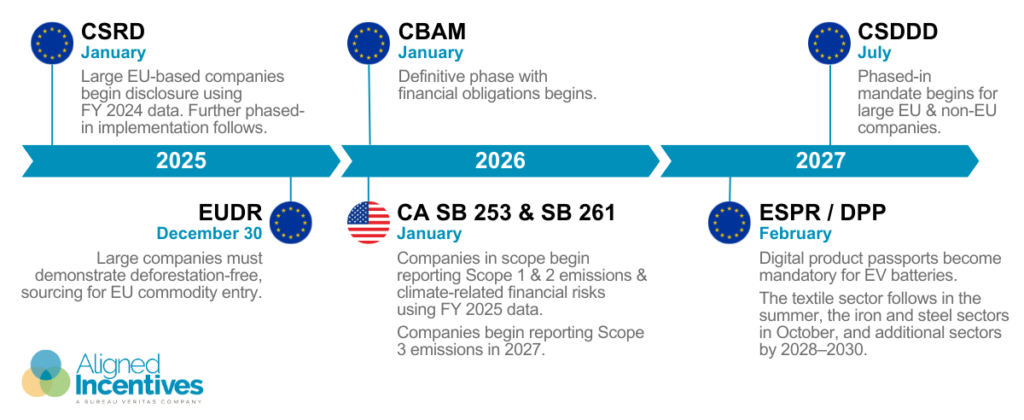

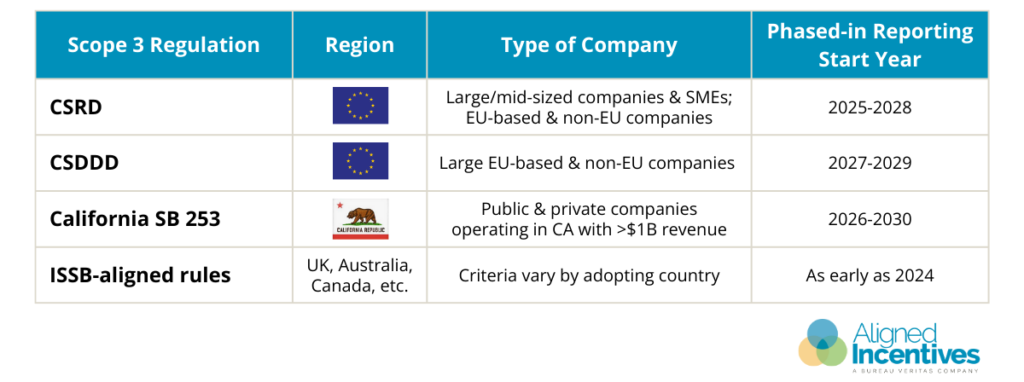

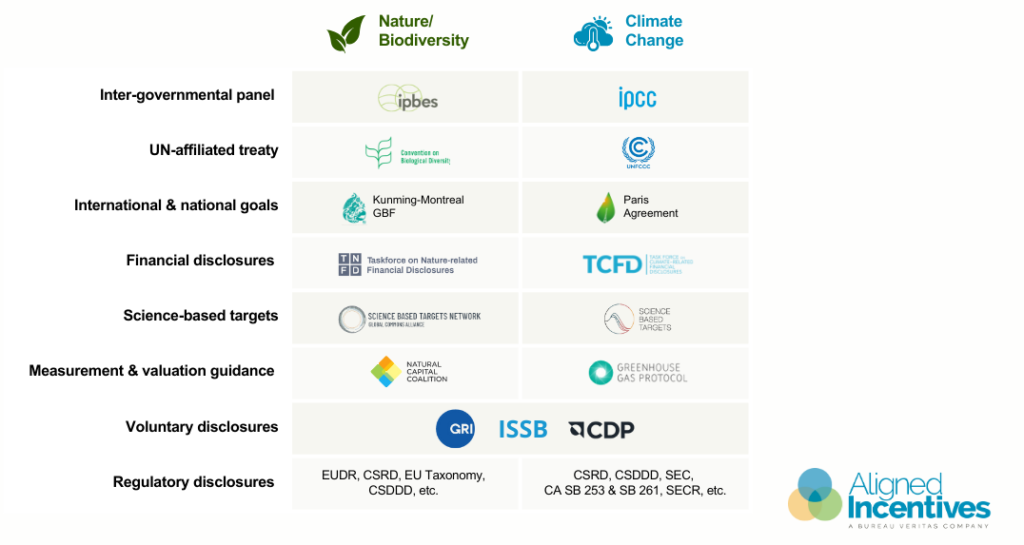

Sustainability reporting will continue to shift from voluntary to mandatory, alongside efforts to consolidate and align standards. The complex web of regulations starting in 2025 includes:

Even with minor EU delays and US national lags, US states and private sectors are part of the global sustainability momentum. ISSB-aligned regulations are in progress and finalized for dozens of jurisdictions, showing more of a harmonized approach. New legislation is also in progress to combat greenwashing.

Enterprises worldwide must be ready to manage multiple regulations, double materiality disclosures (financial plus social and environmental), and future assurance requirements. Building robust inventories of corporate and product impacts enables companies to meet regulations and turn compliance into growth opportunities proactively.

While 79% of companies reporting to CDP in 2024 include some indirect emissions from upstream and downstream supply chains, 45% still omit their most material Scope 3 categories, revealing a critical transparency gap.

Aligned Incentives Co-founder and CEO Yann Risz explains, “Scope 3 faces a trust issue. Calculations are often too broad to be actionable, and supplier data is frequently incomplete or unreliable. As regulatory demands for assurance rise, transparent assessments and verifiable mitigation progress have become increasingly critical.“

To address growing Scope 3 reporting mandates and challenges, 250 sustainability professionals in the Scope 3 Peer Group recommend key actions for 2025, including:

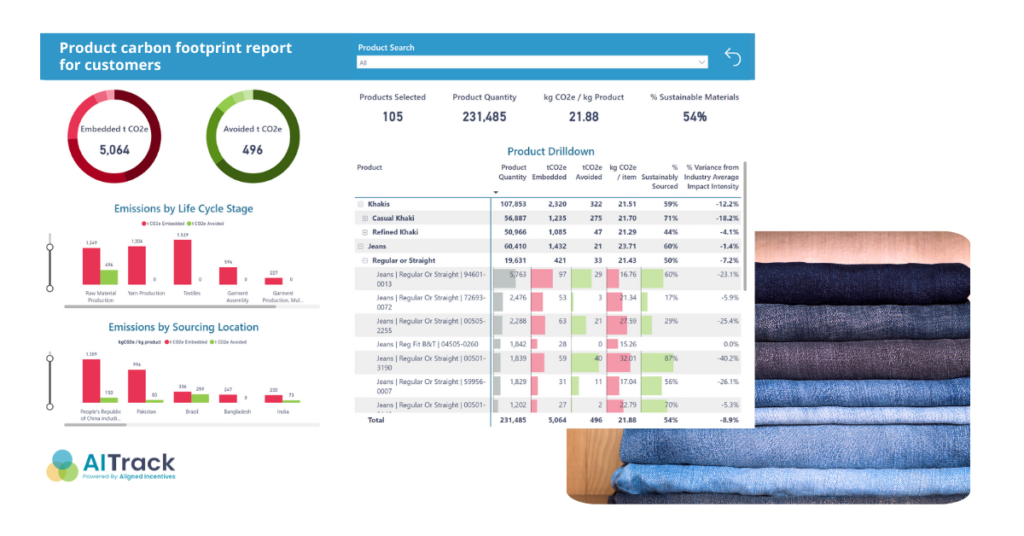

Companies are under growing pressure to develop Product Carbon Footprint (PCF) reports across extensive portfolios. This demand is driven by product regulations (e.g., PEF, ESPR/DPP), industry standards (e.g., PACT), and customer demands. Business buyers are raising the bar for suppliers to meet their Scope 3 compliance and targets. Unilever’s Supplier Climate Program requires key suppliers to provide PCF data. The iMasons Climate Accord, backed by AWS, Google, Meta, and Microsoft, pushes data center suppliers to report product lifecycle impact using EPDs.

Companies need more than high-level averages from fragmented supply networks. Granular product footprint reports and customer-centric communications are the new norm. Companies with scalable PCF capabilities will not only meet compliance requirements but also gain a competitive edge.

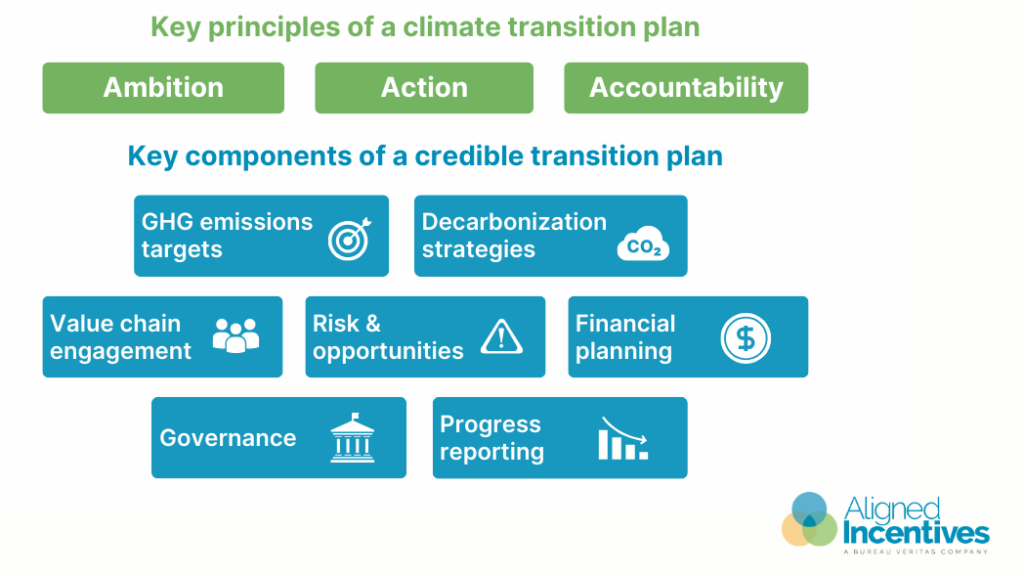

Last year saw a 44% increase in companies disclosing a climate transition plan (or climate transition action plan, CTAP), even with some high-profile walkbacks. More organizations recognize that net-zero pledges are only the beginning, and are committing to time-bound actions to ensure future business success.

The Climate Action 100 investor initiative considers climate risk as an inherent part of financial risk. Detailed corporate action plans are essential to a comprehensive decarbonization strategy. CSRD and ISSB-aligned regulations will also mandate transition plans. Developing a data-driven roadmap that aligns business operations with climate goals is crucial for meeting regulatory requirements and addressing climate action’s growing urgency.

Executives today recognize biodiversity as a business imperative because over half of the world’s total GDP, $44 trillion, is dependent on nature. Climate change and biodiversity loss are inherently intertwined. The 2025 CDP data shows that almost half of companies with climate disclosures also report on biodiversity. This represents the biggest relative growth of any environmental category, with a 165% increase in one year.

Biodiversity data is challenging to monitor and compare without a standardized measurement like CO2 equivalent for climate. Biodiversity regulations are expected to follow a similar trajectory as climate policies, with potential future alignment between the two. Companies should begin understanding and adopting frameworks like TNFD and SBTN to stay ahead of the curve.

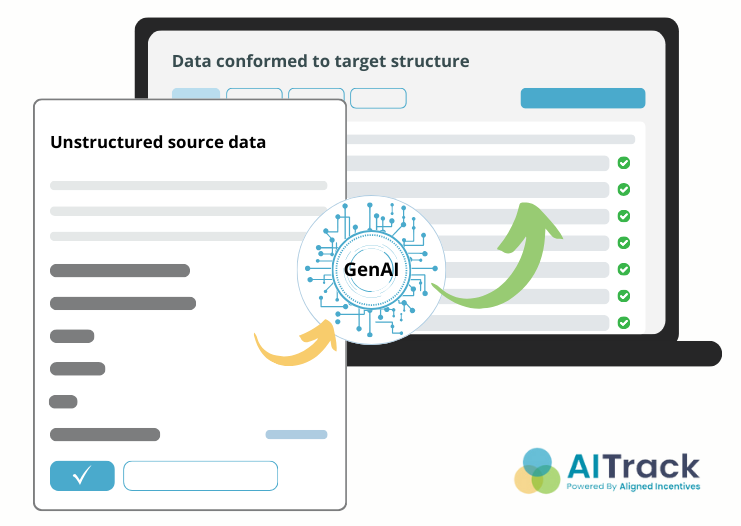

We’ve already seen the positive influence of Generative AI on corporate sustainability capabilities. It is beneficial across multiple use cases: compliance, materiality assessments, data ingestion, reports, and LCA analysis. AI’s efficiencies will also impact our other identified trends, accelerating solutions for complex Scope 3 and nature data, transition planning, product carbon footprints, and regulatory compliance.

However, AI’s environmental footprint presents growing concerns, primarily due to energy consumption, embodied carbon emissions, and water use. While the projected data center impacts are being questioned with the Deep Seek disruption, experts warn that the energy efficiency paradox will continue driving overall energy demand as AI adoption expands.

About Aligned Incentives, a Bureau Veritas company

Aligned Incentives provides an AI-powered sustainability intelligence solution designed for global companies with complex supply chains. Combined with Bureau Veritas’ 200-year expertise in testing, inspection, and certification, we provide all-in-one sustainable value chain solutions, including: